Top 3 Payment Gateways for Small Business 2024

Top 3 Payment Gateways for Small Business in 2024

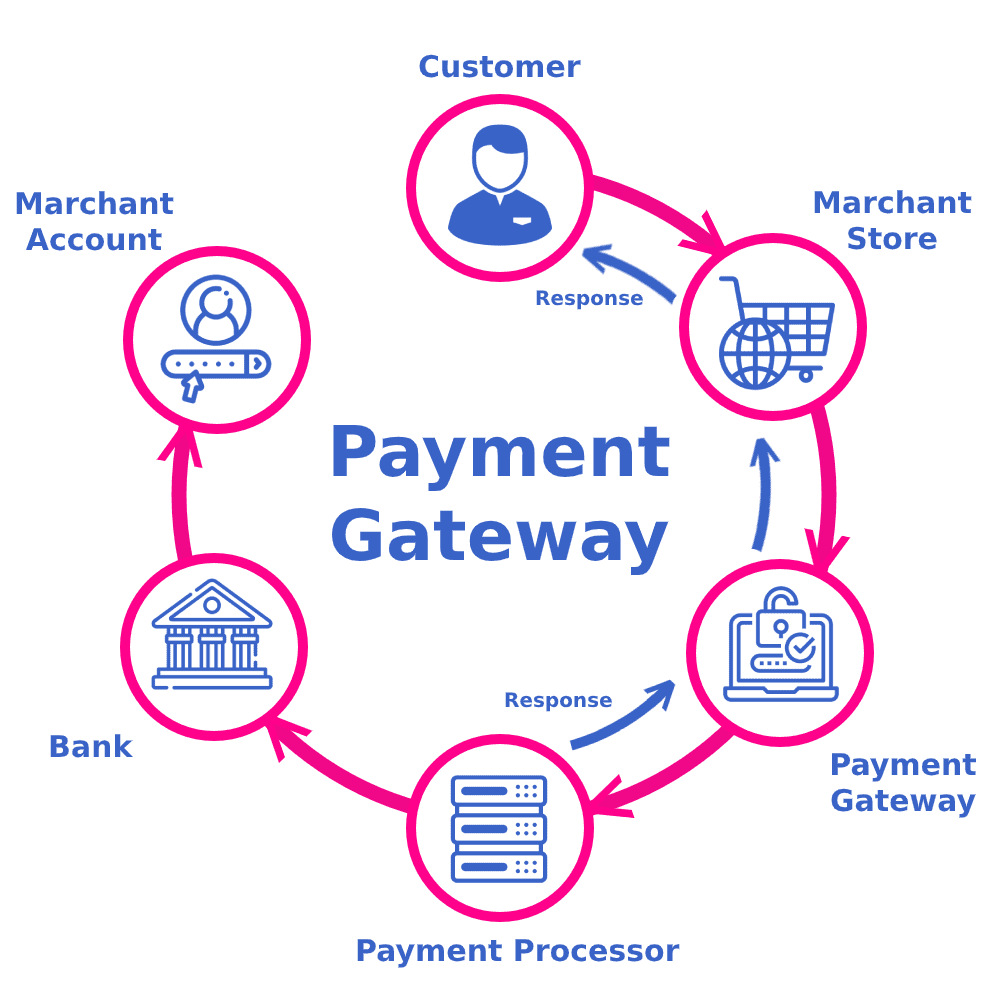

Historically, businesses had to apply for a merchant account to process payments, which involved a stringent underwriting process akin to applying for a line of credit. This process was often time-consuming and required extensive documentation, including financial statements and credit checks.

Nowadays, modern payment processors, including our top picks, no longer necessitate a separate merchant account. Although some have an application process, it’s less rigorous than before, simplifying the account opening process, particularly for new businesses. Instead of upfront risk assessment through applications, modern processors utilize ongoing monitoring with computer algorithms. This shift has made it significantly easier for small businesses to start accepting payments quickly and efficiently.

Modern Security and Risks

Each payment processor on our list offers best-in-class security, ensuring the safety of both your business and your customers. Payment information directly goes to the processor, preventing your business from possessing customers’ credit card numbers and facilitating compliance with credit card industry security guidelines. This not only reduces the risk of data breaches but also helps in maintaining customer trust. Additionally, these processors employ advanced encryption technologies and fraud detection systems to further safeguard transactions.

Our Top 3 Gateways for Small Business 2024

Here are our top three picks for small business payment processors. Generally, each company provides a similar set of features and transaction rates. The subtle differences, such as ease of signup, level of support, and software interfaces, will likely be the determining factors in your decision. These nuances can significantly impact your day-to-day operations and overall customer experience, so it’s essential to consider them carefully. Whether you prioritize seamless integration with your existing systems, responsive customer service, or user-friendly interfaces, our top picks cater to a variety of business needs and preferences.

Top 3 Payment Gateways for Small Business in 2024

-

-

Stripe

-

Stripe, launched in 2010, offers a modern payments platform that makes it easy to accept credit card payments. The signup process is quick and doesn’t need underwriting. While there’s no phone support, their documentation is excellent, and you can chat or email with support.

Who is Stripe Best Suited For?

Stripe is perfect for small businesses with little experience in online payments. The software is easy to use from signup to payment management. If you’re okay with chat or email support, Stripe is a great option for your small business.

-

-

PayPal – PayPal Express Checkout

-

Founded in 1998 and separated from eBay in 2015, PayPal is well-known. The Express Checkout lets customers pay with a PayPal account instead of a credit card, offering a more secure option. It can be used with any other credit card processor on our list.

Who is PayPal Express Checkout Best Suited For?

Almost every small business can benefit from using PayPal Express Checkout with another credit card processor. Giving customers the choice between PayPal and credit cards can boost sales. However, businesses should note that PayPal often sides with buyers in disputes.

-

-

Square

-

Founded in 2009 by Jack Dorsey, Square began as a mobile payments solution and now offers various services, including online payments. Square’s signup is quick and doesn’t need underwriting. Their software is modern, easy to use, and has great support documentation.

Who is Square Best Suited For?

Square is ideal for mobile businesses or those needing both physical and online payment solutions. If you’re already using Square, starting with their online payments is easy. Plus, with $250 of chargeback protection per month, Square helps reduce the risk of accepting credit cards.